Stealth Pension Bailouts Costing Taxpayers a Fortune

- New StatsCan data shows 169% increase in cost to taxpayers for bureaucrat pensions

- Taxpayer contributions to AB's Management Pension up 190%

CALGARY, AB: With Labour Day just around the corner, the Canadian Taxpayers Federation (CTF) released new numbers today on “stealth bailouts” for government employee pension plans.

Virtually every government employee pension plan in Canada hit troubled waters over the past decade, but rather than reform the plans or bail out these plans with large cheque presentations, governments have been quietly increasing taxpayer contributions, creating a “stealth bailout.”

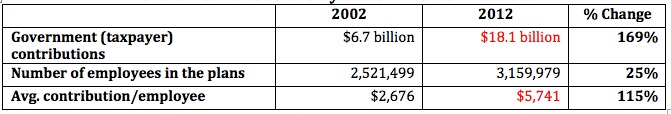

According to Statistics Canada data, governments in Canada put $6.7 billion into government employee pension plans back in 2002. By 2012, that expense had skyrocketed to $18.1 billion; a 169% increase. The CTF calculates the cost per employee at $2,676 in 2002 and $5,741 by 2012; an increase of 115%. These calculations do not include special back payments made by governments.

“It’s not fair for everyday Canadians to have to keep bailing out government employee pension plans,” said CTF Federal Director Gregory Thomas. “Politicians should have reformed these expensive and unstable government employee pension plans years ago. It’s time to act.”

Pension Contributions by Governments in Canada

|

Sources: Cansim Tables 280-0026 and 280-0008. Government contributions do not include back payments, only annual contributions that are based on rising rates. |

In Alberta, taxpayers have paid for similar pension bailouts. In 2001-02, taxpayers put $24 million into the Management Employees Pension Plan (MEPP), or $7,170 per active employee, while employees put in 42 per cent of total contributions.

This already significant gap expanded to where by in 2012-13, taxpayers put $110 million into the MEPP or $20,796 per active employee, while employees contributed 37 per cent of the total.

That means that the average contribution per employee by taxpayers towards the MEPP has increased by 190 per cent over the last 12 years and that taxpayers now put in $2 for every $1 that a MEPP employee contributes.

MEPP Contributions

“This is a stealth bailout of the very richest government pension plan in the province,” said CTF Alberta Director, Derek Fildebrandt. “How can the upper crust of our government demand reasonable reform of the Alberta Public Service Pension Plan out of one side of its mouth when it asks for bailouts of this magnitude with the other side? It’s time for politicians to take action and initiate reforms to make Alberta’s government employee pension plans fair to employees and affordable for taxpayers.”

The CTF has called on politicians to do three things:

1) Lead by example: Convert the MEPP to a defined-contribution model with 50-50 contributions between senior bureaucrats and taxpayers.

2) Stop the bleeding: Just as Saskatchewan's NDP government did in the late 1970s, begin putting new employees into less risky defined-contribution plans; this type of plan protects taxpayers from bailouts.

3) Make do like everyone else: Introduce “targeted-benefit” clauses for existing plans. This requires the plans to pay out what they can afford rather than a fixed formula approach.

The CTF sent a letter to Finance Minister Doug Horner outlining its position on pensions during consultations late last year.

The CTF also released two YouTube clips to explain these bailouts to the public – click here and here to view them.